The sour taste of inflation: The impact of inflation on UK wages

6 Jan 2025

Nick Litsardopoulos, Research Economist (Fellow)

This blog was originally published in December 2024 on the website of Adzuna, one of the largest online job search engines in the UK.

The COVID-19 pandemic lockdowns of factories and businesses created bottlenecks in the global supply chains that reduced the flow of goods across countries and within local markets. While in the short run the demand of local markets was satisfied, the uncertainty about the duration of the lockdowns around the globe together with the differing approach to lockdowns of governments around the world added to the ongoing turbulence. The fear and uncertainty created a bizarre behaviour of consumers who begun to purchase products in bulk out of fear of coming shortages, which led to empty supermarket shelves.

This consumer behaviour led to short term shortages in retail goods that exacerbated supply chain problems. The combination of fear, uncertainty, supply chain bottlenecks and consumer behaviour, along with marketeers who saw an opportunity for extra profit, the outcome was that demand for several products ended up being higher than what the market could supply. To make things worse, the escalation of Russo-Ukrainian War in February 2022 and the resulting US and EU sanction on Russian goods and services resulted in soaring energy and fuel prices. If that was not enough, the UK’s official exit from the European Union on the 31st of January 2020 triggered customs checks which encumbered commerce between the UK and the EU. From January 2021 to May 2024, UK consumer prices increased by 22.8% in total, compared with 20.9% in Germany, 18.8% in the US and 16.6% in France.

The past few years have been a rollercoaster for the UK labour market, with inflation emerging as a critical factor reshaping workers’ economic realities. Inflation has dramatically transformed purchasing power and real wage dynamics. Post-COVID-19 the UK experienced unprecedented inflationary pressures. Between 2022 and 2024, inflation rates soared well above historical averages, creating significant challenges for employees and employers alike. UK inflation surged to levels not seen since the 1980s.

The Consumer Price Index (CPI) and Consumer Price Index including Owner Occupiers’ Housing Costs (CPIH) reveal a stark economic narrative:

- Peak inflation reached 11.1% in October 2022, the highest in 41 years

- Average annual inflation between 2022-2024 remained around 6%

- Nominal wage growth failed to keep pace with these extreme inflation rates

The period between January 2022 and October 2024 represents a critical moment in UK economic history, characterised by a profound disconnect between nominal wages and real economic value. To truly understand the impact, we must examine the mechanics of this “hidden wage cut”. Consider a typical UK worker earning £35,000 in 2022. With inflation rates reaching a record high of 9.6%, Consumer Prices Index including owner occupiers’ housing costs (CPIH) over the period Jan 2022 – Oct 2024 at 17%, this individual would need their salary to increase to approximately £41,000 just to maintain the same standard of living in 2024. However, most employers were unable to match such significant wage increases. The data tells a stark story:

- Average wage growth between 2022-2024 hovered around 5-6%

- Inflation outpaced wage growth by 2-3 percentage points annually

- This resulted in a cumulative real wage decline of 15-20% over two years

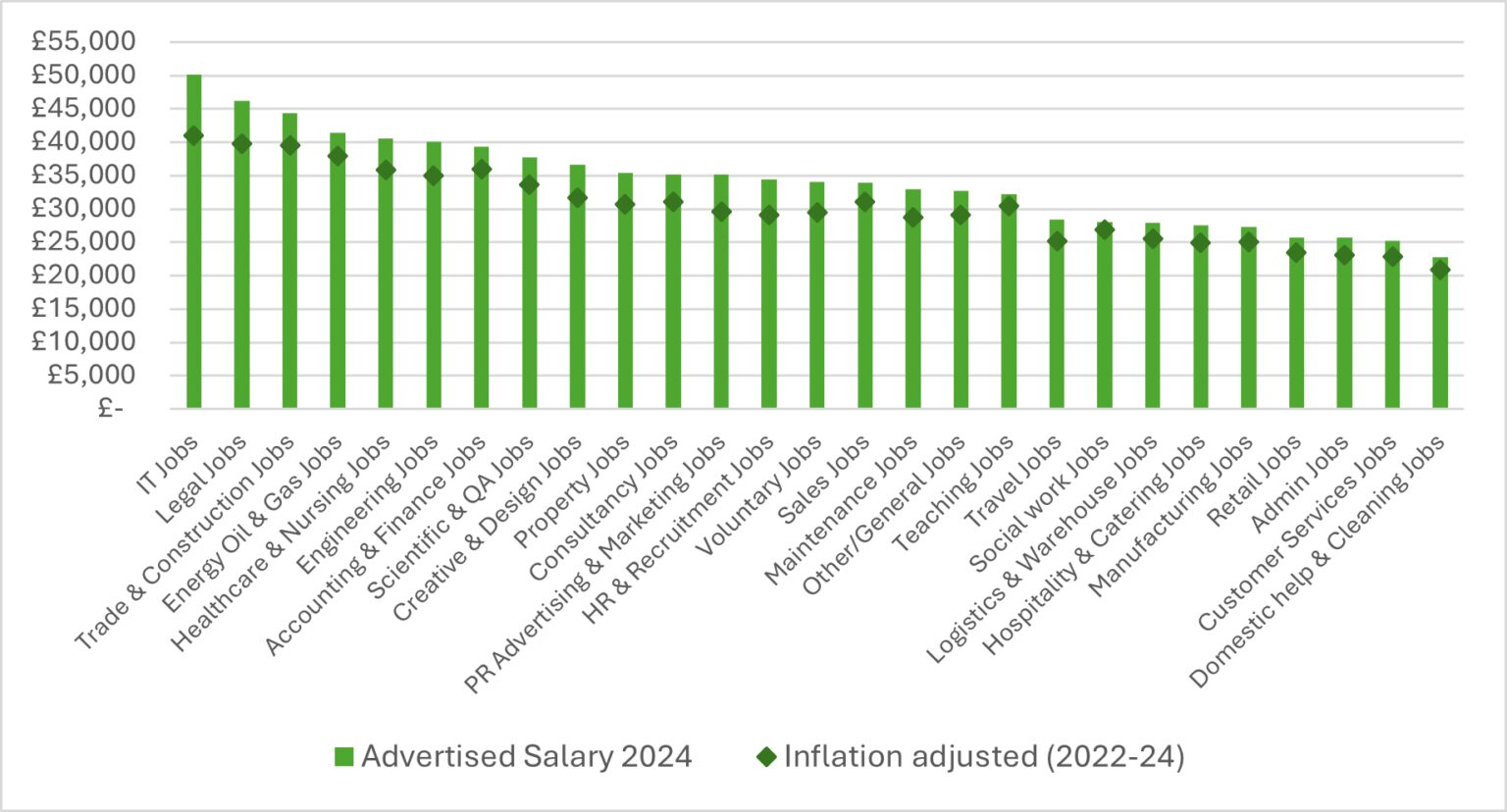

Using the Adzuna intelligence portal we can examine the advertised job vacancy salaries change over the period 2022-2024, and then see how salaries perform after accounting for the inflationary pressure over the period. When we plot the average advertised salaries across job sectors we see two things: one is that some sectors increased their offered salaries a lot more than others. This indicates that together with any effort to attract talent, employers in those sectors where the large increases are observed tried more than others to adjust the salaries offered to match inflation. More importantly however, is that none of the average sector-offered salary meets the inflation increases over the same period. Notable increases are observed in the Social Jobs sector, and Teaching Jobs sector, where at least the average salary increase was above 10%. The lowest increase is observed in the IT Jobs sector where the average offered salary actually saw a decrease. This might be a reflection of the decrease in the demand for programmers and software developers in the UK.

The next stem in this exercise is to adjust the advertised median salaries across job sectors for the inflationary pressure since 2022. When we plot the median advertised salaried for each job sector, we see that every sector experienced an effective decrease in salaries. Any gains, if one can call it that, appear to be in job sectors typically offering lower salaries. Some interesting shifts can be observed in the order of the nominal offered salaries and inflation adjusted salaries of Accounting & Finance jobs, Sales jobs, Teaching jobs, and Social work jobs, which, after the inflation adjustment, have landed in a higher position than what their nominal salary would suggest.

It becomes evident that some job sector industries managed a more aggressive compensation adjustments than others. Salaries in Travel jobs and Voluntary jobs were particularly vulnerable to purchasing power erosion, due to the already low sector compensations. Beyond pure numbers, this hidden wage cut has profound implications, such as increased financial stress for employees, reduced consumer spending power, potential long-term economic slowdown, and challenges in employee retention and motivation.

This inflationary period stands out even when compared to previous economic challenges. The speed and magnitude of purchasing power decline were unprecedented in recent UK economic history. While UK inflation has fallen in recent months back within the target range of the Bank of England (BoE), the compounding effects have created a cost-of-living crisis. Salaries were already increasing at a slower pace than inflation for years before the price hikes in consumer goods and energy during the pandemic and afterwards. Using the BoE inflation calculator one can easily see that a £35,000 salary in 2010 could buy you as much as a salary of £53,000 in 2024. Yet most of the jobs that were offering £35,000 in 2010 offer far less than £53,000 in 2024. For example, a graduate job in 2010 offered a median salary of £27,000, with some generous salaries at investment banks or law firms offering around an average of £38,000 and £37,400 respectively. In 2024 a graduate job offered a median of £30,000, that is, a small 11% increase since 2010.

Understanding inflation’s impact is crucial for navigating the current job market. Both job seekers and HR professionals must remain economically literate and adaptable in this challenging environment. The hidden wage cut of the pandemic era serves as a powerful reminder of the importance of understanding economic dynamics beyond nominal salary figures.

Any views expressed are those of the author and not necessarily those of the Institute as a whole.